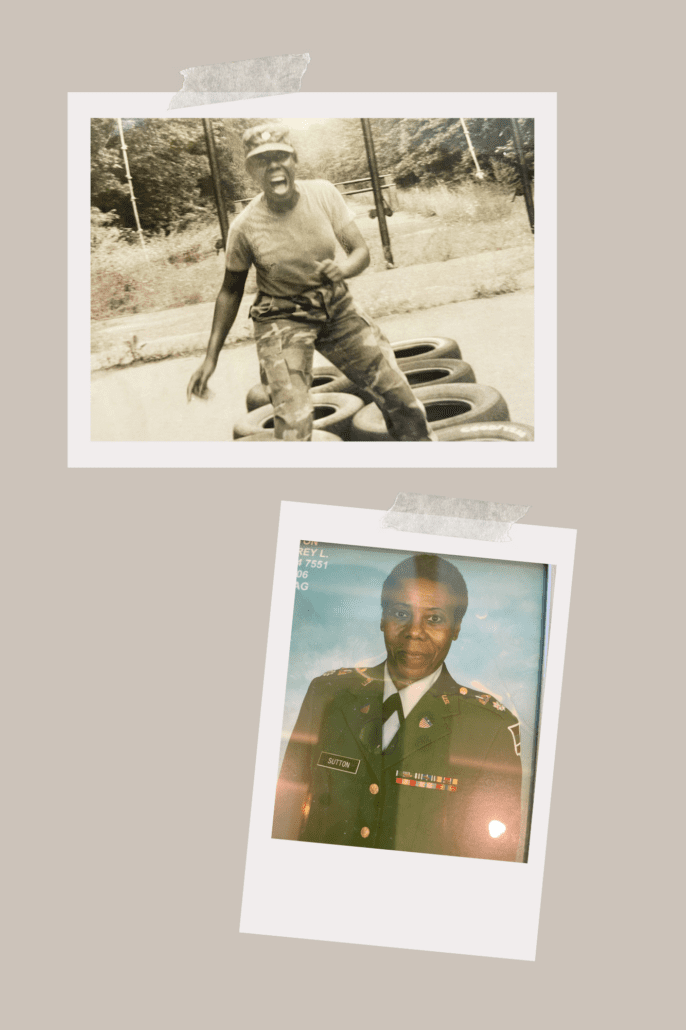

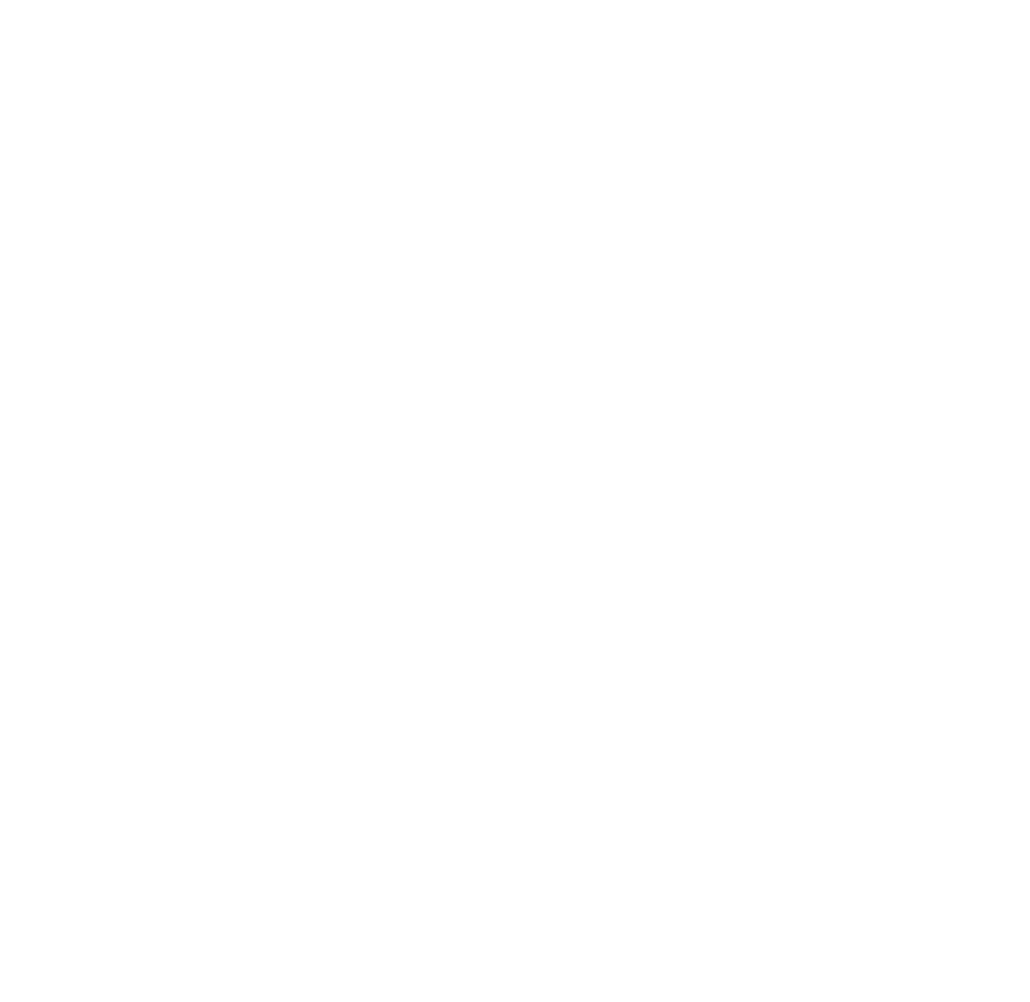

Audrey Sutton, Lieutenant Colonel, U.S. Army, Retired

Lakeside Villa Resident

In 1974, when JKV resident Audrey L. Sutton was the 26-year-old director of a community mental health center in Baltimore City, Maryland, she got an offer she couldn’t refuse. A Colonel whom she respected very highly dared her to try out to be in the Women’s Army Corps (WAC) Reserve. In order to recruit women, the Army’s basic training program had been reduced from eight weeks to two weeks, and with her MSW (Masters in Social Work) degree, Audrey was promised a Second Lieutenant rank upon graduation from basic training.

Always one to accept a positive challenge, Audrey enlisted almost immediately. Upon graduation from basic training at Fort Benning, Georgia, she was named “Honor Trainee of the Cycle.” Unfortunately, by the time she graduated, the program she had been enrolled in had been absolved, so instead of beginning her Army career as a Second Lieutenant, she began as a Private — the very bottom of the rank structure.

Audrey was extremely disappointed at this turn of events but decided to make the most of the situation and gave it her all, working very hard and meeting challenge after challenge. She spent some time as an enlisted soldier. During this time, her most memorable experience was when she scored 300 (the maximum score) on the physical training test. This was the first 300 score in the Battalion. The Battalion Commander was so impressed with this score that she submitted an article to the Washington Post recognizing the achievement.

After serving as an enlisted soldier for a period of time, her Battalion Commander enrolled Audrey in OCS (Officers’ Candidate School), a one-year training course. As a Reserve, she trained one weekend a month at the District of Columbia Armory. She graduated from OCS as a Second Lieutenant and received the first-ever Commandant’s Professional Award.

Audrey spent two years as a Second Lieutenant and received an early promotion to First Lieutenant. She was selected to become a company commander. Her primary duties and responsibilities included preparing the Company for an Inspector General Inspection, which the Company passed for the first time in three years. She also provided leadership and support to Company soldiers, especially during weekend training and challenging field exercises.

In 1983, she was promoted to Captain and was stationed at the Reserve Center in Baltimore City, Maryland. She was assigned another company command in Dover, Delaware. Up to this point, command positions in that battalion were always held by white males. Audrey was truly a trailblazer. For two and a half years as Commander, she traveled to the U.S. Army Reserve Center in Dover to serve one weekend a month.

After her command there, she received a promotion to Major and was stationed at Fort Belvoir, Virginia as a Military School Commandant and also served as Adjutant. Her duties included guiding and advising the overall Commander’s decisions regarding soldier welfare activities and concerns.

While serving as a Major, Audrey graduated from Equal Opportunity (EO) School in Cocoa Beach, Florida. As an Equal Employment Opportunity Officer, she taught classes of male and female soldiers about sexual harassment, what it was, that it would not be tolerated, and how to report any incidents that might occur.

After serving three years as School Commandant, she was promoted to Lieutenant Colonel and stationed at 80th Division in Richmond, Virgina. Her primary duty was that of Personnel Director, but she also performed other duties as assigned. She retired from the military in 2003.

During her military career, Audrey also held a number of full-time civilian positions, including Chief of Child Care for the City of Baltimore and Director of Child Welfare Services that oversaw Child Protective Services, Foster Care, Adoption and Family Services programs in Prince George’s County, Maryland and in Washington, D.C. After retirement from the military, she entered the private sector as the Chief Executive Officer of an adoption and foster care agency.

Audrey feels blessed to have had the support of her mom and her four siblings. Her mom told her, “Honey, aim high and never quit. Expect to win and stay tough. Remember, the difference between wishing and accomplishing is action.” These are words Audrey chose to live by throughout her 29-year military career—especially when she came out of Basic Training as a Private instead of the Second Lieutenant rank she had been promised.

When we asked Audrey if there was a person she served with that she remembers fondly, she immediately thought of her First Sergeant, Jean Branch, who she really admired. According to Audrey, “I was a First Lieutenant with no experience being a military leader.” Sergeant Branch assured her, “If you follow my lead, you’ll be fine.” Audrey did as Sergeant Branch suggested and they problem-solved together, which led to their becoming an outstanding Company with many commendations. Jean and Audrey became close friends, with a wonderful friendship that lasted through the ages.

Bill Sullivan, U.S. Army Colonel, Retired

Westlake Resident

Bill was drafted in 1969 and reported for induction at the AFEES station in Jacksonville, Florida just as Neil Armstrong was taking man’s first step on the moon. From there, he was sent to Fort Dix, New Jersey, for basic training at a Private E-1. Bill graduated nine weeks later and received his officer’s commission as a Reserve Army Captain in the Judge Advocate General’s Corps. From Fort Dix, he was sent to Fort Lee, Virginia, for a two-week officer orientation course. Bill’s next assignment was to JAGC School at the University of Virginia for the two-month JAG Basic Course. The group graduated at Christmas in 1969 and received orders to report to their first duty station in January 1970 in Fort Riley, Kansas. Bill worked for a Colonel he respected, so when he was reassigned to Army Headquarters in Okinawa, which was then a Protectorate of the U.S., Bill requested to go with the Colonel. He received his reassignment to Okinawa a few months later. Bill and his wife Judy had their first child at Fort Riley, and when Judy arrived in Okinawa, she was ripe with baby number two, who was born a month later.

Bill’s most memorable assignment was as a member of the Army Homecoming Team, Operation Homecoming, Clark Air Base, Republic of the Philippines, from January 1973 to April 1973. Hostilities had just ended in Viet Nam and the POWs were being repatriated from their POW camps. Many were flown to Clark Air Force Base in the Philippines for debriefing, then to Germany, and then to the States. The Army had its team of doctors, social workers, chaplains, lawyers, and finance officers to deal with any questions or concerns that the men may have had. Bill vividly remembers standing on the tarmac at Clark as the Air Force transports landed and the men came down the boarding ramps. He states that there was not a dry eye in the house. That very scene was repeated many years later as the troops were coming home to Hunter Airfield in South Carolina after the first Gulf War as he stood on the tarmac at Hunter.

Okinawa was his terminal assignment, and after his discharge in 1974, he and Judy, with their two young daughters, moved to Lighthouse Point, Florida. Bill is from Miami, and Judy is from Coral Gables, so moving to South Florida was an easy decision. Bill started practicing law with his fraternity brother Peter Portley in 1974, and they continued to practice together until they both retired in 2020.

Bill’s active-duty career was from 1969 to 1974. He had the foresight to stay in the Active Reserves and retired as a Colonel in 1997. Bill concludes, “I always smile when someone thanks me for my service because I truly feel that I got more than I gave. Judy and I loved the culture of the military community, and we made so many great friends and shared so many wonderful experiences. There is a comradery of military service that is hard to explain unless you have experienced it. Judy and I both loved it, and we will always cherish the memories.”

As we celebrate Armed Forces Day around the nation, we would like to thank all members of the Armed Forces, past and present, for their dedication and service to our country. At John Knox Village, we treasure the many veterans who call JKV home. We’re honored to have them here.

We invite you to visit John Knox Village of Florida to learn more about us and see what sets us apart from other senior living communities. JKV is a life plan community offering an exceptional lifestyle and the financial security of having a plan in place for any future care that might arise.

To learn more, contact us for a conversation or to schedule a tour.

![]()