Meet the Experts at JKV: Fitness Manager Erik Nenortas Helps Residents Achieve Their Personal Best

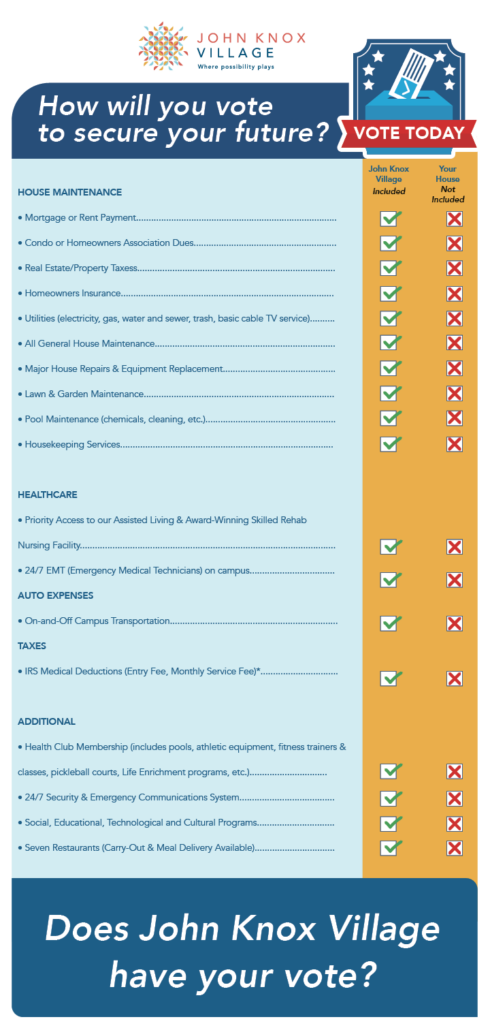

John Knox Village of Florida, Inc. (JKV), an internationally award-winning Life-Plan Continuing Care Retirement Community in sunny Pompano Beach, Florida, is renowned for its innovative wellness and life enrichment for all residents.

Fitness Manager Erik Nenortas, a 28-year employee, is a fitness professional and Certified Therapeutic Recreation Specialist (CTRS) who leads the Best-In-Class team of licensed professionals, full-time trainers, and class instructors who teach throughout JKV’s 70-acre campus.

Erik is responsible for all fitness staffing, gym equipment, and class implementation. JKV currently has 47 fitness classes per week. Individual personal training and classes are held at the Fitness Studio, Aquatic Complex, Village Centre, Cassels Tower, Heritage Tower, and Village Towers apartment building party rooms. There are many classes to choose from including aerobics, strength & balance, aquatic fitness, karate, Tai Chi, Pilates, yoga, pickleball, meditation, and Parkinson’s Wellness Recovery.

Erik states, “Do your very best to help others succeed in life! By believing in those words, I have based my education and career on making sure I engage in work that assists others to improve both physically and cognitively. Working at John Knox Village for the past 28 years has enabled me to assist residents by promoting various specialized programs to help improve their spiritual, social, physical, emotional, and cognitive well-being.”

According to Gail Sutton-Pauling, Vice President of Hospitality at JKV, “Erik is truly in tune with our residents. He has an incredible knack for understanding their needs and desires, and he consistently implements programs and activities that resonate with them. His dedication and insight make a significant positive impact on the lives of our residents every day.”

Erik Nenortas, Fitness Manager at John Knox Village

Erik earned his Bachelor of Science in Recreation Therapy from the University of Florida in 1996. For 20 years, he dedicated himself to enhancing the well-being of residents at JKV through structured activity programming. Working closely with individuals of varying cognitive abilities, he embraced each challenge as an opportunity to foster meaningful connections and help residents maintain their functional abilities.

In 2009, Erik expanded his expertise by earning his Certified Personal Trainer (CPT) and Group Fitness Instructor certifications from the World Fitness Association. His passion for health and wellness led him to transition from Recreational Therapy to the JKV Fitness Team in 2017. Over the years, he continued to advance his skills, earning additional certifications, including AEA Aquatic Fitness Instructor, PWR! Moves Teacher, Group Meditation Certification, and National Academy of Sports Medicine Personal Trainer Certification.

In May 2024, Erik was promoted to Fitness Manager at JKV, where he now leads a talented team dedicated to helping residents achieve their fitness goals. His approach to his career is rooted in positivity, guided by the philosophy, “Let the beauty of what you love be what you do.”

Reflecting on his journey, Erik shares, “I am most proud of managing two departments — first, assisting residents socially and cognitively in Recreational Therapy, and now, as Fitness Manager. I love working with my team and supporting residents at every skill level.”

We invite you to learn more and experience our breathtaking campus, astounding amenities, remarkable residents and exceptional team members like Erik who all make JKV extraordinary. Contact us today to learn more and schedule a visit.