It takes time to build wealth, create trusts and develop an estate plan to protect and preserve one’s assets for future generations.

By Scott Montgomery, CLU, ChFC

By Scott Montgomery, CLU, ChFC

Annual reviews of your financial accounts are critical to ensuring your wishes are followed after you are gone.

Whether you do this at the start of the year or after filing your tax returns, check how your accounts are titled and who is named beneficiaries to ensure this information matches your current life circumstances and evolving tax laws.

A mistitled financial account or lack of a named beneficiary can lead to a wide array of potential problems down the road. For example, if it has been several years since you last updated your retirement plan’s beneficiary designation form, the assets you intend to pass to a current spouse or children may end up in the hands of a former spouse. Instead, make it a habit to regularly review your estate plan and ensure your assets are adequately protected within the context of current laws, including the tax code.

Account Ownership

The law provides individuals with options for structuring ownership of real and personal property, including bank accounts, brokerage accounts and retirement savings accounts. How these assets are titled, especially when they are owned by two or more people, can help to avoid probate at the time of one account owner’s death and limit exposure to potential legal judgments and tax liabilities in the future.

Joint Tenancy with Rights of Survivorship allows property owned by a deceased individual to pass outside of probate directly to the other property owner(s), who consequently can receive a step-up in their share of the property’s cost basis and minimize their exposure to capital gain taxes should they sell the property in the future.

However, it is important to note that Joint Tenancy with Rights of Survivorship overrides any wishes an individual expressly communicates in their will. Should a decedent wish to pass an asset to someone other than the co-owner, an estate tax liability may be unknowingly created when the second owner passes away. Therefore, careful planning is essential.

Joint Tenancy by the Entirety applies only to property a married couple owns together. Because this form of ownership considers the couple to be one entity, it protects assets from creditor claims filed against one of the spouses while also allowing assets to transfer outside of probate directly from one spouse to the other.

Tenancy in Common tends to create a probate issue when one owner passes away. The decedent’s interest in that property becomes a part of their estate, which can be passed to beneficiaries named in their will.

Beneficiary Designations

Titling property ownership is not the only way to direct how your assets will be distributed at the time of your death. While you may use your will to communicate the individuals you wish your assets to pass to, the beneficiaries named on your retirement accounts and life insurance policies will ultimately receive those assets. Conducting regular reviews of your will against your account beneficiary designations and asset ownership structures can help avoid conflicts that may prevent an inheritance from going to the intended beneficiaries.

Trusts

Another strategy for avoiding the very public and costly probate process and ensuring assets pass to intended beneficiaries is to create a trust in which you specify how and to whom you wish your assets to be distributed after you pass away. Assets transferred into the trust should be retitled to reflect the trust as the new owner. Remember to continue funding the trust to ensure it serves its intended purposes. Failing to do so is like having a house with no furniture. It’s nice, but it won’t meet all your needs.

Every estate is unique and requires a review of an individual’s needs and goals to optimize plans for building wealth in life and distributing assets to care for future generations after death. Working with experienced financial planners to appropriately title accounts can help to ensure these goals are met while protecting assets and minimizing tax liabilities.

About the Author:

Scott Montgomery is a director and financial planner with Provenance Wealth Advisors (PWA), an Independent Registered Investment Advisor affiliated with Berkowitz Pollack Brant Advisors + CPAs and a registered representative with PWA Securities, LLC. He can be reached at the firm’s Ft. Lauderdale, FL. office at (954) 712-8888 or [email protected].

This material is being provided for information purposes only and is not a complete description or a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove correct.

Any opinions are those of the advisors of PWA and not necessarily those of PWA Securities, LLC. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of PWAS, we are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional. Prior to making any investment decision, please consult your financial advisor about your individual situation.

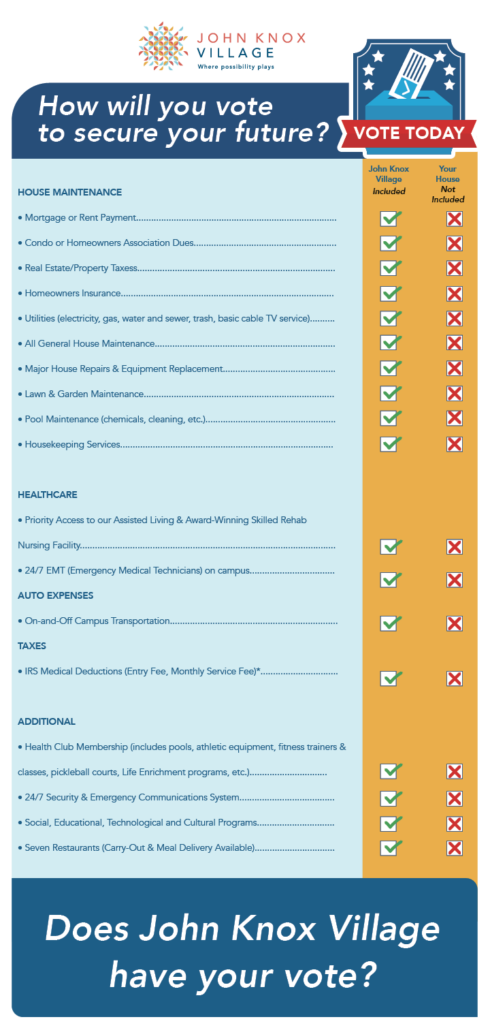

About John Knox Village

John Knox Village, set on a scenic 70-acre campus, is South Florida’s leading life plan or continuing care retirement community, celebrating 57 years of excellence.

JKV offers a comprehensive approach to retirement with a continuum of care including independent living, assisted living, memory care, and skilled nursing. Our elegant residences, vibrant community, and extensive amenities—including an Aquatic Complex, diverse dining options, fitness centers, and cultural activities—ensure comfort and promote enrichment.

Our caring team is committed to providing personalized support in a life plan community, delivering peace of mind for residents and their families.

Interested in learning more about John Knox Village? Contact us today for a no-pressure conversation with a Life Plan Consultant, or to schedule a visit.

By Scott Montgomery, CLU, ChFC

By Scott Montgomery, CLU, ChFC