Be in the Know: Life Plan Communities Offer Some Valuable Tax Benefits

When looking at retirement living options, buying or renting into a senior living community are well-known options. But choosing to live in a Life Plan Community offers some valuable federal tax benefits that other senior living options do not. Read on to learn more.

What is a Life Plan Community?

Life plan communities, also known as continuing care retirement communities (CCRCs), provide the security of having a plan in place for any future healthcare needs that might arise. Residents live independently, knowing if they ever need care, they’ll have it. Most CCRCs offer multiple service levels: independent living, assisted living, skilled nursing, and memory support services, all available when you need them.

What are the tax benefits?

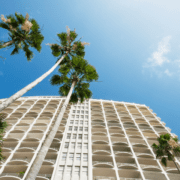

Current federal income tax laws permit residents at Life Plan Communities or CCRCs like John Knox Village in Pompano Beach a tax deduction on a sizeable portion of the one-time entrance fee the year of move-in. In addition, a percentage of the monthly service fees paid during each year can be itemized as a medical expense.

At the beginning of each year, in some communities, such as John Knox Village, auditors calculate the portion of the Entrance Fees and Monthly Service Fees that are attributable to medical expenses and provide this information to residents for their tax preparation.

Can a financial advisor help me navigate this?

Tax and financial advisors can play a crucial role in helping seniors living in CCRCs and Life Plan Communities navigate the complexities of tax laws related to their unique situation. An advisor can help you understand CCRC-related tax deductions, such as:

• The amount or portion of your healthcare services and fees to the CCRC, as applicable

• Other potential itemizable deductions, such as local income taxes related to living in a CCRC

• Specific tax implications of different types of CCRC contracts, including the nuances of life care, fee-for-service, and other modified contracts

In addition, financial advisors can help seniors project future healthcare needs and provide guidance on potential tax implications for accessing long-term care services within or outside of the CCRC.

How much can I deduct?

According to Carol Enisman, Investment Advisor Representative and Managing Partner at Premier Wealth Planning in Fort Lauderdale, “The current tax code allows you to deduct a portion of your unreimbursed medical and dental expenses that exceed a set percentage of your Adjusted Gross Income.”

However, she says, it’s important to note that you’ll need to itemize your deductions rather than take a standard deduction, which would disqualify you from claiming medical expenses.

I’m not sure which type of care contract I’m going to choose. Can you tell me the tax benefits of each?

The tax benefits may vary, depending on which type of care contract you select. A Life Plan Community Consultant can explain the different contract options, including Type A, B, and C contracts, and what each includes. Depending on how much healthcare coverage is included in the contract you choose, the medical expense tax benefit may vary.

For some types of CCRC contracts, a portion of the entry fee and monthly fee may be applied toward future medical expenses. Essentially, this portion is considered a pre-paid medical expense and may be included as part of your annual medical expenses.

It’s always best to speak with your tax professional, who will be able to advise you with up-to-date tax regulations.

Are there any other tax deductions seniors should keep in mind when filing taxes?

Most of us know that medical bills, hospital bills, prescription costs, dental and vision care, in-home medical care, and costs for hearing aids and glasses are tax deductible.

Another hidden gem that might surprise you is that the standard mileage rate for driving to and from doctor appointments, therapy sessions, and other medical care is also tax deductible.

JOIN US FOR A FREE TAX SEMINAR IN MARCH

Join us for a free seminar on Monday, March 11, 2024 at 11:00 am, at the John Knox Village Auditorium. We’re excited to welcome Carol Enisman, Investment Advisor and Managing Partner, and Ariel Enisman, Estate Planning and Asset Protection Attorney from Premier Wealth Planning in Fort Lauderdale, to our campus. JKV Residents and guests are welcome.

Carol will focus on the importance of proper tax planning, tax filing updates, and optimization strategies and will offer a new client discount of 25% for tax preparation this year. Ariel will be speaking on wills, trusts, probate avoidance, and the importance of proper estate planning.

Premier Wealth Planning works with clients to understand the complexities of the tax code and how it applies to residents of a CCRC. Non-JKV Residents who are interested in attending are welcome. Please call John Knox Village at (954) 783-4040 to RSVP.

Premier Wealth Planning Mandatory Disclaimer:

Securities are offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a SEC Registered Investment Adviser. Cambridge and Premier Wealth Planning are not affiliated. Cambridge and Asset and Estate Planning, LLC are not affiliated. Cambridge does not offer tax nor legal advice.