John Knox Village 101: Answers To Frequently Asked Questions

Making the decision about where to spend one’s golden years is a significant one, and many in the 62-plus set are turning their attention towards life-plan continuing care retirement communities (CCRCs)—such as John Knox Village—as a promising option.

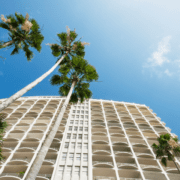

As South Florida’s premier CCRC, JKV offers a comprehensive living solution with the appealing blend of independent living, assisted living, supportive memory care and nursing care—all within 70 beautiful botanical acres in the hidden-jewel city of Pompano Beach, Florida.

Given the interest and common queries around this topic, let’s delve into some of the questions JKV’s Life Plan Consultants are asked daily.

What Is A Life-Plan Contract?

A Life-Plan Contract is an insured agreement between you and the community that entitles you to live in one of our independent living apartment or villa homes. Because residents are purchasing a life-plan insurance contract, all CCRCs in Florida are regulated by the Office of Insurance Regulation as specialty insurers, and the Agency for Health Care Administration (AHCA) regulates the provisions of health care.

If, or when, your health situation changes, as a JKV Life-Plan resident, you are entitled to the unlimited use of Gardens West, our assisted living residence, as well as our highly rated rehab, long-term nursing, and memory support centers, The Woodlands, and Seaside Cove.

Paying the one-time Life-Plan entrance fee assures you of a lifetime of unlimited healthcare services. Choosing a CCRC means you will know where, and from whom, you will receive healthcare and that your loved ones will be spared the difficulty of making care decisions during a health crisis.

What Is JKV?

JKV is celebrating its 57th anniversary of providing a holistic approach to retirement living, focusing on health, wellness, and an enriched lifestyle. Residents have the peace of mind knowing they will enjoy a continuum of care designed to meet their changing needs as they age—spanning independent living, assisted living, supportive memory care, and skilled nursing care.

Residents enjoy a rich tapestry of amenities, including an Aquatic Complex boasting resort-style and lap pools, seven dining venues, fitness studios, cultural and recreational activities, award-winning life enrichment programming and beautifully landscaped grounds, all nestled on a picturesque 70-acre campus.

As a not-for-profit CCRC, our dedicated team of professionals delivers personalized care with compassion and respect, ensuring peace of mind for both residents and their families.

Isn’t It Better To Wait To Move To JKV?

Senior living experts agree that the best time to make a move is while you’re active and enjoying good health. At JKV you must be at least 62 to purchase a life-plan contract.

Additionally, moving to a CCRC, like JKV, also safeguards your assets from future healthcare costs should you need care. Assisted living, skilled nursing, and memory support expenses can quickly add up and create financial stress for you or your family if you’re unprepared.

Also, consider costs like home repairs, property taxes, and homeowner’s insurance. Moving to a CCRC eliminates these costs as well as the worry and expense of maintaining a home. For a detailed side-by-side comparison of expenses covered while living at JKV compared with staying in your house, talk to a member of our professional staff.

We all hope to be healthy far into our senior years, but the future is unpredictable and procrastinating a move puts you at risk of not passing the health assessment required for admission.

What Fees Do JKV Residents Pay?

As a JKV resident, you will pay a one-time Entrance Fee, along with a Monthly Service Fee (MSF). The MSF includes all maintenance on your apartment home or villa, housekeeping, a dining plan and use of all the incredible on-campus amenities.

Most importantly, you will be covered for future healthcare costs as outlined in your life-care contract.

Are There Tax Benefits To Living In A CCRC?

You may be eligible for significant IRS medical deductions on both the Entrance Fee and Monthly Service Fee. We recommend consulting a professional financial planner to help determine your eligibility for deductions. A member of our professional staff can also answer your questions and provide details.

What Types Of Residences Are Available?

We offer residences ranging from one to two-bedroom with den apartment homes, with many sizes and floorplans available. In addition, we offer villas, which are single-story attached homes with one-and two-bedroom floorplans.

Will I Need Insurance?

JKV provides insurance for the buildings and grounds. As a resident, your only insurance need would be a renter’s policy to cover personal property and liability.

Can I Decorate My Residence?

Yes! You may furnish and decorate your apartment or villa home to reflect your personal taste.

Is JKV Pet-Friendly?

Yes! Many residents have furry and feathered friends who also call JKV home. We have a dedicated Wellness Park on campus warmly referred to as the JKV Dog Park.

If you have additional questions or are interested in learning more, contact us today and a JKV Life-Plan Consultant will be happy to provide the answers you need or assist you with scheduling a visit to John Knox Village.