Surfside Ushered in a New Era for Condo Living

On June 24, 2021, the Champlain Towers in Surfside, Florida, tragically collapsed, killing 98 people and leaving hundreds more temporarily homeless. The upcoming third anniversary of this tragedy hits especially close to home, having occurred right here in our own South Florida community.

In the aftermath of this catastrophe, home insurance premiums have significantly increased, and condominium association fees have skyrocketed.

When the Florida Legislature passed Senate Bill 4-D in May 2022, it created new requirements for condominium and co-op buildings three or more stories tall. As a result of the Surfside collapse, the bill aims to improve building safety and maintenance standards with significant provisions related to roofing and building inspections with another new requirement: to reserve funds to pay for future long-term maintenance repair.

With these changes comes a hefty price tag. As home insurance prices steadily climb in the state with the threat of damaging storms and in the aftermath of Surfside, the steep rise in association fees has forced many people to relocate.

Homeowner’s Insurance Blues

While inflation cooled in 2023, prices for goods and services remain high, with no relief in sight. Last year, the Insurance Information Institute predicted that insurance in the Sunshine State could increase by 40%, and the average Florida homeowner is paying $6,000, more than triple the U.S. average of $1,700. Plus, insurance carriers are clamping down on renewals. As one example, Progressive Insurance announced that it plans to send out non-renewal notices to half of its insurance policies in December. This would impact an estimated 100,000 homeowners in Florida.

Florida Senate Bill 4-D – And What it Means for Condo Owners

Senate Bill 4-D requires condos higher than three stories to be inspected every 10 years once they hit the 30-year mark, and for those within three miles of the coast, this inspection is required for buildings 25 years and older. The first milestone inspection must be completed by December 31st of its 30th year.

There are 25,000 condo associations and 1.4 million individual condominiums in the state, and according to the CRC Group, a wholesale specialty insurance group, nearly 600,000 of these condos are over 40 years old. For older adults who have lived in their condos for years, the high expense of assessments and monthly fees can become unbearable, forcing them to move. Even older adults who are financially secure are fleeing their condominium homes.

Waiving Reserve Fund Contributions is a Thing of the Past

Another major change to Florida condo law will impact how associations handle reserved funds. Associations previously had the freedom to waive reserve contributions from their homeowners, but by December 31, 2024, they will no longer have that option. As a result, after January 1, 2025, all condo associations will be required to be on track to collect enough reserve funds to pay for replacement costs in the event they are needed, which is sure to translate to higher association fees for condo owners.

An Alternative To Skyrocketing Costs

With all the changes that condo associations are implementing as a result of changing regulations and the consequences that they bring to condominium owners, this may be the smartest time to sell. For seniors over the age of 62, moving to an active senior Continuing Care Retirement Community (CCRC), also known as a Life Plan Community, could be a very smart financial move toward protecting your assets.

“Often [outside] people don’t realize how much money JKV residents are saving,” Thom Price, vice president of Operations at JKV, told The Gazette. “Residents’ monthly service fees cover the equivalent of someone’s mortgage or rent. In addition, it pays for what would be association fees, property taxes, insurance, utilities, home maintenance, repairs and equipment replacement, lawn care, 24/7 security, on-site healthcare, while also providing a lifelong healthcare contract.”

A Life Plan Community is a senior living option that eliminates many costs that homeowners and condo owners are burdened with and instead, in addition to the benefits already stated, offers residents a set entry fee, with a stable monthly service fee that includes dining, lifelong learning opportunities, social and cultural arts events and housekeeping. It also offers some unique tax advantages. In short, it is an investment in yourself, rather than in a property’s association.

With all the changes that condo associations are implementing, and the financial consequences those changes are bringing to condo owners, Mr. Price affirms this may be the best time for seniors over the age of 62 to move to an active Life-Plan Community, such as John Knox Village.

“Frankly, this is the time to make a very strategic financial move for seniors to protect their assets, while enjoying their life’s next chapter in a Life-Plan community,” he said.

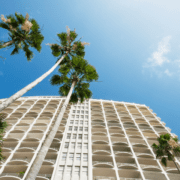

John Knox Village in Pompano Beach, Florida, is an internationally award-winning Life Plan Community boasting a lush, tropical 70-acre campus, resort-style amenities, a wellness-based lifestyle, and long-term healthcare should you ever need it. In many ways, JKV provides a safe haven from rising homeowner and condo costs and peace of mind for your future.

Want to learn more about what John Knox Village has to offer? Contact us today to schedule a tour, or for a no-pressure conversation with one of our Life Plan Consultants.