Welcome to CFO in the Know – Your Financial Questions About Life Plan Communities Answered

Douglas Folsom, CFO (Chief Financial Officer), has been with John Knox Village for six years, serving as its Controller prior to being named Chief Financial Officer in 2023. He has been at the forefront of the Village’s fast but disciplined growth while keeping a close eye on JKV’s financial steadiness. He is often asked important questions regarding living at JKV, which is why we started this informative series—to help you make well-educated decisions regarding your future.

Douglas Folsom, Chief Financial Officer, JKV

Dear Doug: Is moving to a Life-Plan Continuing Care Retirement Community (CCRC) like John Knox Village a wise investment? — Undecided in Deerfield

Dear Undecided in Deerfield,

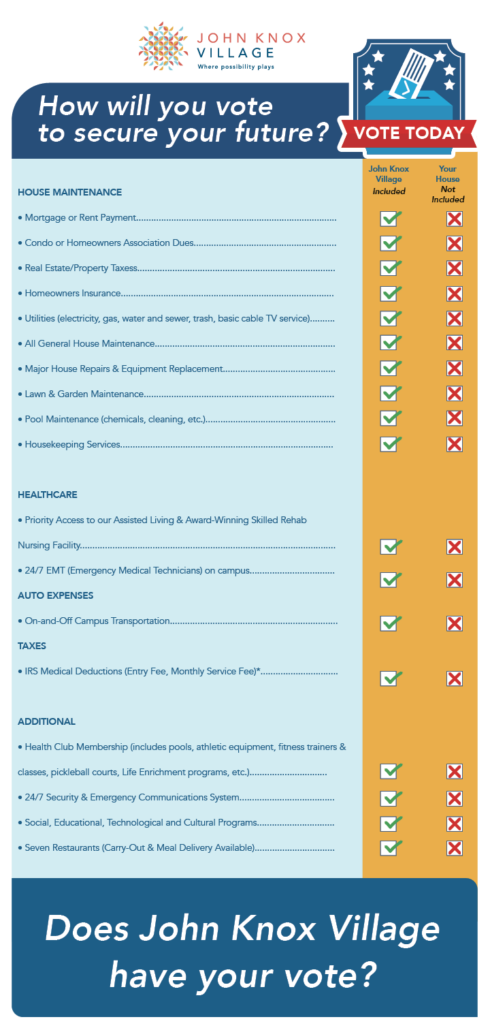

As the CFO at John Knox Village (JKV), I would consider it a wise investment for several reasons. Firstly, it provides comprehensive care and services under one roof, offering residents stability and familiarity as their health needs change. A Life-Plan Community, like JKV, ensures access to a full continuum of healthcare options, from independent living to assisted living, skilled nursing, and supportive memory care. This guarantees that as your health evolves, you remain within the same community, surrounded by familiar faces and settings, alleviating the stress of relocating during a health crisis.

Financially, it makes sense to invest in a Life-Plan Community, like JKV. The cost of healthcare, particularly long-term care, continues to rise in the U.S., making it essential to plan proactively. By paying a Life-Plan entrance fee, you secure lifetime access to unlimited healthcare services, which can provide significant financial stability.

For example, a non-JKV resident in skilled nursing care would pay privately an average of $15,000 per month, versus a Life-Plan resident paying a current average monthly service fee of $5,000 – a significant cost savings! This is particularly important given the unpredictability of healthcare needs and costs.

Additionally, a Life-Plan Community, like JKV, offers a rewarding lifestyle, filled with rich social and cultural experiences, peace of mind, and a sense of security. Many of our residents would recommend considering a CCRC as it provides quality care and ensures that residents do not become a burden to their families or the state as they age.

By choosing John Knox Village, you are making a sound investment in your future that not only ensures access to high-quality healthcare, but also promotes an active, purposeful, and fulfilling retirement.

About John Knox Village

John Knox Village, set on a scenic 70-acre campus, is South Florida’s leading life plan or continuing care retirement community, celebrating 57 years of excellence.

JKV offers a comprehensive approach to retirement with a continuum of care including independent living, assisted living, memory care, and skilled nursing. Our elegant residences, vibrant community, and extensive amenities—including an Aquatic Complex, diverse dining options, fitness centers, and cultural activities—ensure comfort and promote enrichment.

Our caring team is committed to providing personalized support in a life plan community, delivering peace of mind for residents and their families.

Interested in learning more about John Knox Village? Contact us today for a no-pressure conversation with a Life Plan Consultant, or to schedule a visit.

By Scott Montgomery, CLU, ChFC

By Scott Montgomery, CLU, ChFC